tn franchise and excise tax mailing address

For industrial recruitment information call the Department of Economic and. For questions or assistance with this form please call 615 253-0700 Monday through Friday 830 am-430 pm.

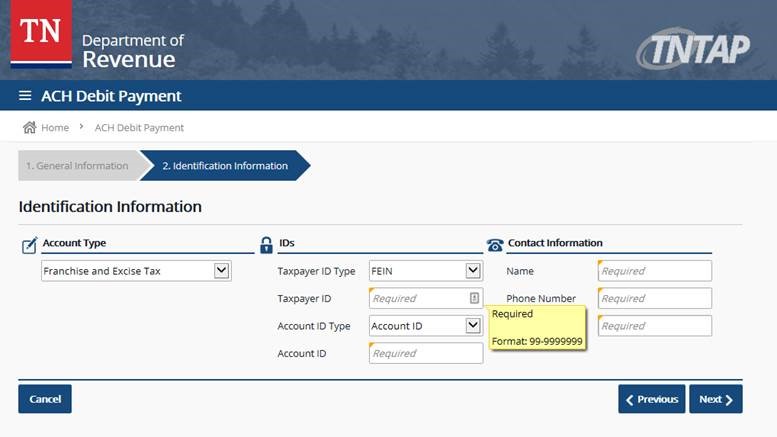

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

The Tennessee Franchise and Excise tax has two levels.

. Please mail completed applications and annual renewals to. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year. Fill in payment details.

ET-2 - Federal Bonus Depreciation is. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone. Tennessee Department of Revenue Attention.

REASON FOR APPLICATION New Exemption 2. The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398. Schedule X - Job Tax Credit.

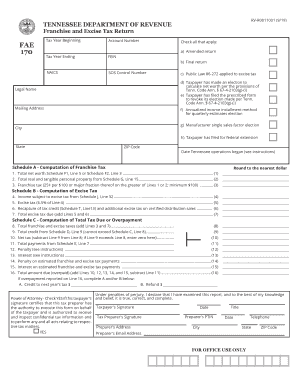

Please view the topics below for more information. Box 190644 Nashville TN 37219-0644 For tax assistance call 800 397-8395 in Tennessee or if you are located in the Nashville call area or out-of-state call 615 253-0700. Franchise and Excise Tax Return Kit FAE170 - Franchise Excise Tax Return 2022 RV-R0011001 921 TENNESSEE DEPARTMENT OF REVENUE 2021 Franchise and Excise Tax Return FAE 170 Tax Year Beginning Account Number Tax Year Ending FEIN Check all that apply.

Tennessee Department of Revenue PO. The excise tax is based on net earnings or income for the tax year. Mail the completed Business Plan to.

Please view the topics below for more information. TAX PERIOD COVERED Start. The Tennessee Department of Revenue recently extended the franchise and excise tax filing and payment deadlines to May 16 2022 for four additional counties impacted by severe weather on Dec.

A Amended return b Final return NAICS SOS Control Number c Public Law 86-272 applied to. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. 025 per 100 based on either the fixed asset or.

FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption. If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero. Franchise Excise Tax Forms Mail to the following address.

Franchise Excise Tax - FONCE. 4 rows Business Mailing Addresses. Andrew Jackson State Office Building.

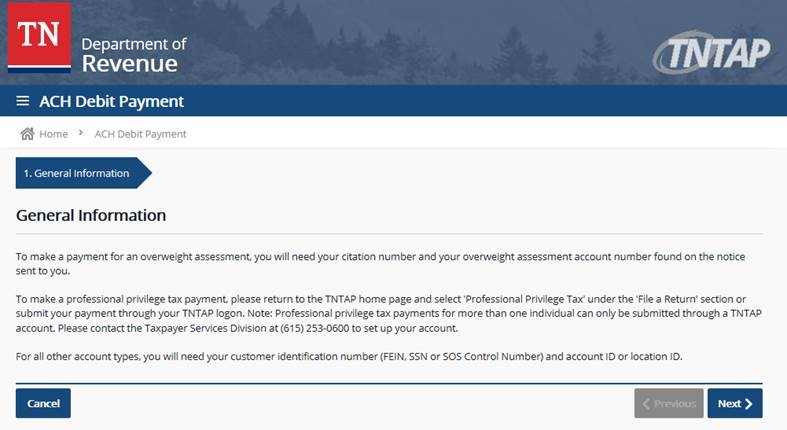

TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. Choose the Period this should be the filing period end date you want the estimated payment to be credited towards. 615 253-0700 1-800-342-1003 ln State Toll-Free E-mail.

Box 190644 Nashville TN 37219-0644 For tax assistance call 800 397-8395 in Tennessee or if you are located in the Nashville call area or out-of-state call 615 253-0700. FRANCHISE AND EXCISE TAXES COMPLETE THIS APPLICATION TO REQUESTEXEMPT STATUS FROM FRANCHISE AND EXCISE TAXES 1. Input the Contacts name phone number and email address.

Business Forms Application for Extension of Time to File Franchise Excise Tax Return. Franchise Excise Tax - Excise Tax. These letters identify the account as a franchise excise tax account.

Fill in the Taxpayer ID Type ID and Account ID. Tennessee Department of Revenue 500 Deaderick Street Nashville TN 37242. ENTITY NAME AND PHYSICAL LOCA TION 5.

Mail the completed Business Plan to. Captive REIT Disclosure Form. Effective date of registration with the Secretary of State.

Instructions for filing FAE 182 185 186 187 using the Tennessee Taxpayer Access Point TNTAP Financial Institutions Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. If calling from Nashville or outside Tennessee you may call 615 253-0700. CST or visit wwwtngovrevenue for more detailed information.

Franchise Excise Tax Return Mailing Address Tennessee. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. Effective May 28 2018 franchise excise tax account numbers now called IDs have been updated from nine digits to 10 digits followed by the letters FAE.

Tennessee Department of Revenue. ET-1 - Excise Tax Computation. The number is 800 397-8395.

ENTITY MAILING ADDRESS Name. 65 excise tax on the net earnings of the entity and. The additional counties to be granted the extension are Davidson Henderson Henry and Sumner.

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee. Tennessee Department of Revenue PO. You can read frequently asked questions about the Family Owned Non-Corporate Entity Exemption FONCE exemption for franchise and excise tax here.

The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents. To qualify for the job tax credit. If you have questions about Franchise And Excise Tax Online contact.

Schedules 174SC 174NC Consolidated Net Worth Apportionment. For Account Type choose Franchise Excise Tax. 8 rows Statewide toll-free.

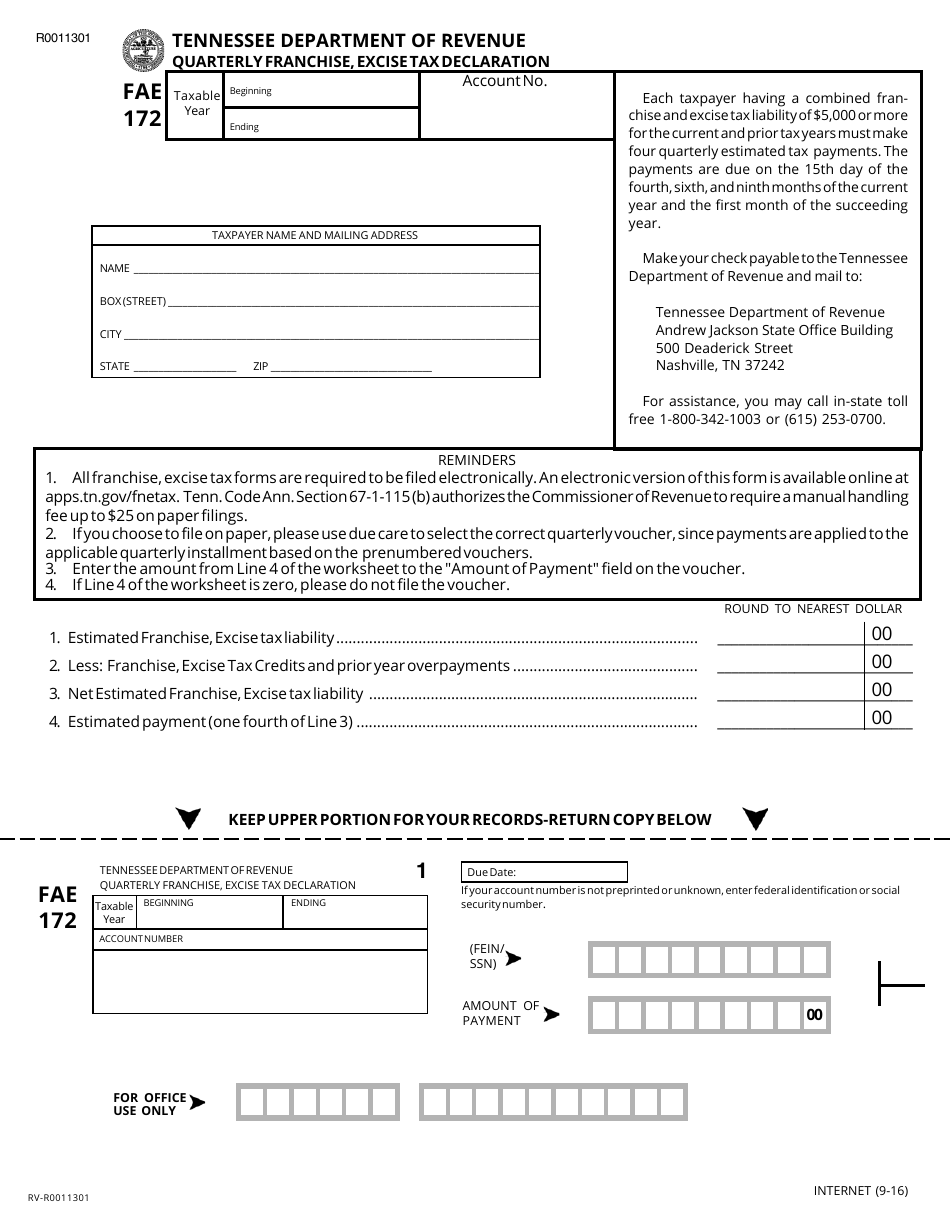

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

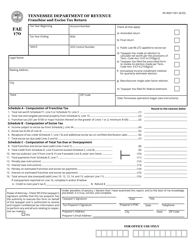

Form Fae 170 Franchise And Excise Tax Return Kit

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Franchise Excise Tax Price Cpas

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fill Free Fillable Forms State Of Tennessee

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Tn Fae 170 Fill Out And Sign Printable Pdf Template Signnow

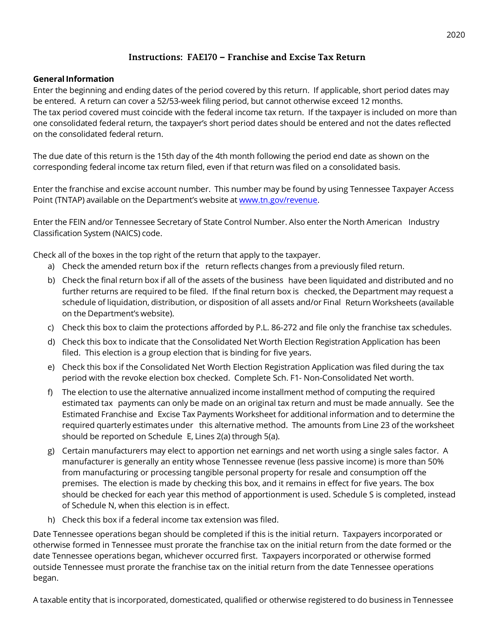

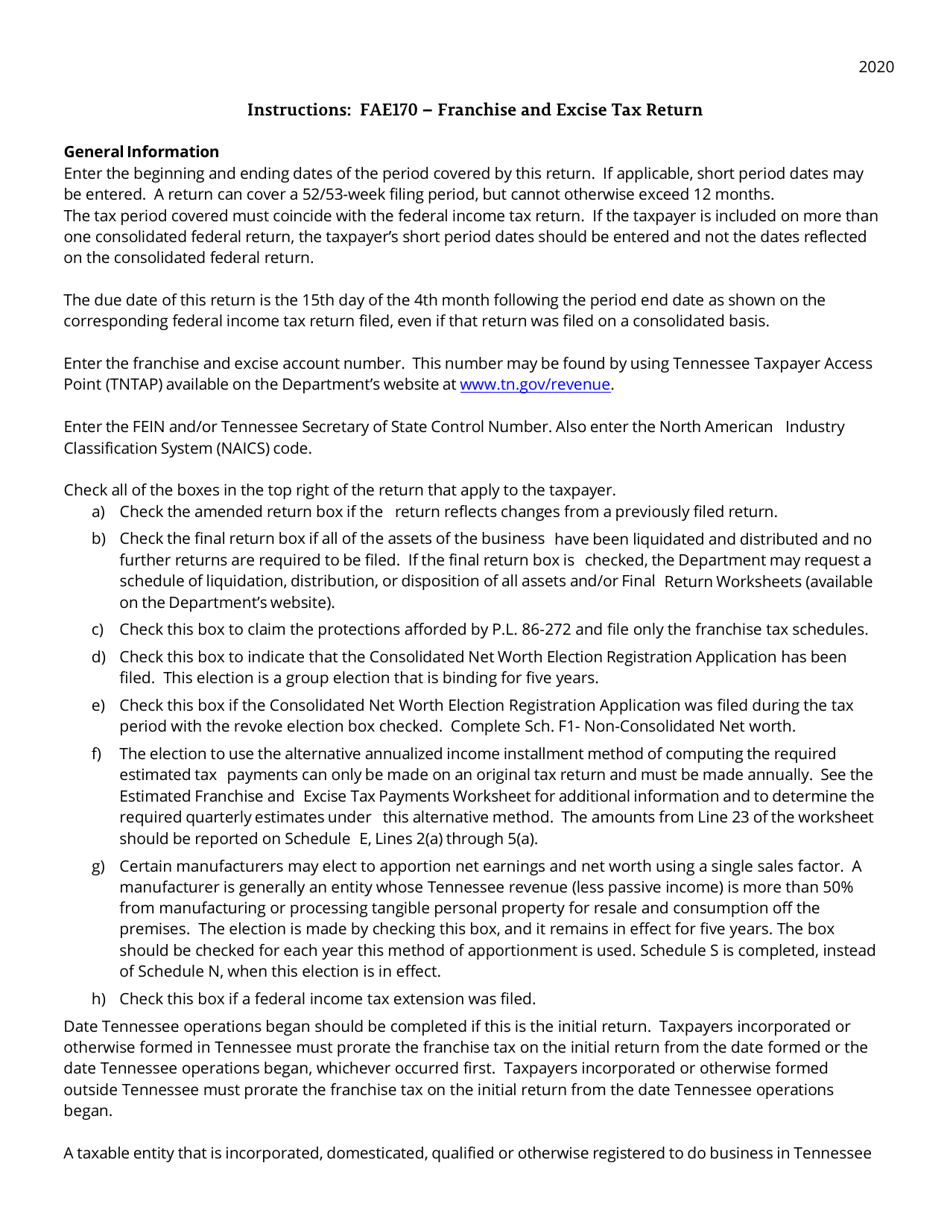

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Franchise Excise Tax Tn Investco Entities Youtube

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller